26+ deducting mortgage points

Web Mortgage points Homebuyers often pay cash upfront to lower their mortgage rate for the life of the loan. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for.

Solved Joe Earns 39 000 Per Year And He S Paid Monthly His Monthly 401k Course Hero

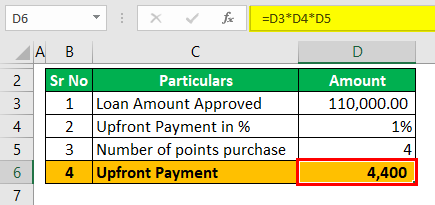

Web A mortgage point sometimes called a discount point is a fee you pay to lower your interest rate on your home purchase or refinance.

. Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Web Deducting points means you can deduct 130th of the points each year if its a 30-year mortgagethats 33 a year for each 1000 of points you paid. You can deduct the rest of the mortgage points over the life of the loan.

Web For example if your mortgage points totaled 5000 and you took out a 15-year fixed youd be able to deduct roughly 333 annually 5000180 months 2778 x 12 months 333. Web Up to 96 cash back You meet the first six points under Deducting mortgage points in the year paid above. Web If youve closed on a mortgage on or after Jan.

For example paying an extra 1 of the loan amount can lower the interest rate by 025. One discount point costs. Usually your lender will send you.

Youll need to itemize your deductions on Schedule A Form 1040 to. The first year you took out the mortgage would probably be less because you would make fewer than 12 monthly payments. Web Generally your home mortgage interest is tax deductible up to 750000.

Apply Online Get Pre-Approved Today. Web Mortgage points are considered an itemized deduction and are claimed on Schedule A of Form 1040. File your taxes stress-free online with TaxAct.

Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. Web Mortgage points are considered prepaid interest and are tax deductible for the year you buy the house. Web Use Code Section Number 26 US.

Filing your taxes just became easier. Web There are two types of mortgage points. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Origination points and discount points. Ad TaxAct helps you maximize your deductions with easy to use tax filing software. Origination points are basically what they sound like.

Code 461 - General rule for taxable year of deduction for the amortization of points. Mortgage Ending Early If you again refinance the loan. For most taxpayers this means your entire mortgage interest is able to be deducted.

Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. Youll pay 3000 at closing if you take out a mortgage for. Here are the specifics.

Web If you meet all the above criteria you can either deduct all your points in the year you paid them or deduct them in equal increments over the life of the loan. Homeowners who bought houses before. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

Compare Best Mortgage Lenders 2023. Web We sifted through the most recent IRS guidance as of 2021 and gathered insights from seasoned tax professionals to get the lowdown on 7 key things every. Fees paid to the lender for.

Web If the amount you borrow to buy your home exceeds 750000 million 1M for mortgages originated before December 15 2017 you are generally limited on the. Web One point costs one percent of your mortgage amount or 1000 for every 100000 you borrow.

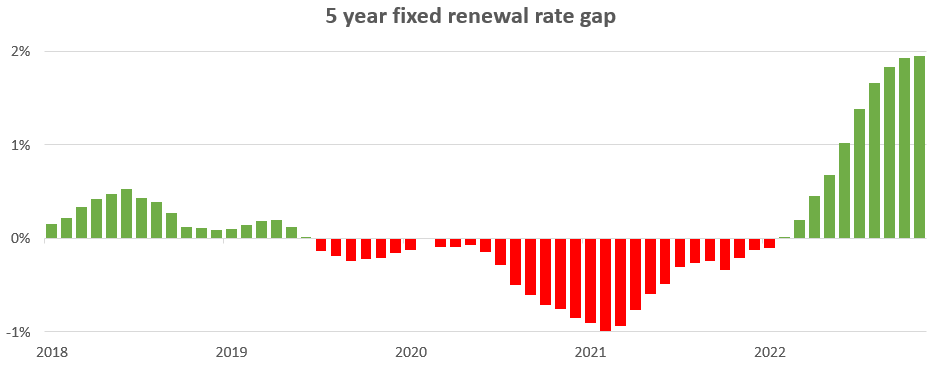

Changing Rates And The Market House Hunt Victoria

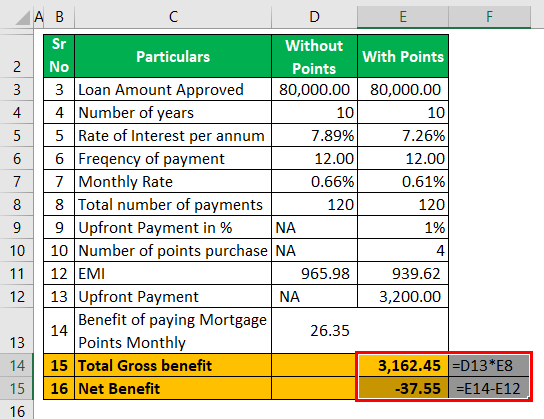

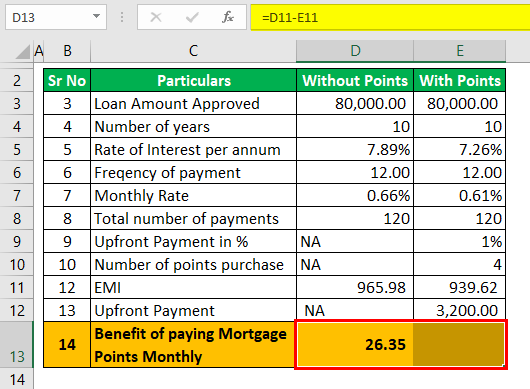

Mortgage Points Calculator Calculate Emi With Without Points

Scientific Bulletin

Mortgage Points Calculator Calculate Emi With Without Points

Gpmtq32020investorpresen

Open Esds

Compass Clock Spring Summer 2018 Publication

Merritt Herald November 29 2012 By Black Press Media Group Issuu

Home Mortgage Loan Interest Payments Points Deduction

Mortgage Points Deduction Itemized Deductions Houselogic

Mortgage Points What Are They And Are They Worth It

What Are Mortgage Points And How Do They Work Ramsey

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Request Is This Accurate Both His Statement And The Response R Theydidthemath

Mortgage Points Calculator Calculate Emi With Without Points

The Role Of Mortgage Points In A Low Rate Market

How To Deduct Mortgage Points On Your Tax Return Turbotax Tax Tips Videos